Building a Home with a Minor Dwelling – The Advantages

Building a Home with a Minor Dwelling – The Advantages

Home Plus attached Minor Dwelling

What are the Advantages, who is building them and why?

In today’s housing market, building a home that includes a minor dwelling (granny flat) is becoming a popular trend in New Zealand.

It’s an exciting option, especially for families and savvy investors alike, who are looking to make the most of their space and finances. But what’s all the buzz about?

Let’s dive into why building a home with an attached two-bedroom minor dwelling could be a game-changer for you.

Perfect for Families with Multi-Generational Living

One of the biggest advantages of building with a minor dwelling (granny flat) is the flexibility it provides for families. More and more Kiwis are embracing multi-generational living – parents, kids, and grandparents all under (or near) one roof.

An attached minor dwelling offers the perfect solution, giving everyone their own space while keeping the family close. Imagine having your parents or in-laws living right next door, helping the kids into a home, and sharing everyday life.

It’s a way to live independently but together, and it can be a more affordable solution than separate homes. Plus, when family members pool their resources, financing the build becomes easier.

Combining incomes to obtain a mortgage is a smart move when lending rates are high, like they have been recently, but the good news is rates are beginning to drop. By 2025, we’re expecting even better conditions for those looking to build, making the timing ideal for families ready to make a move.

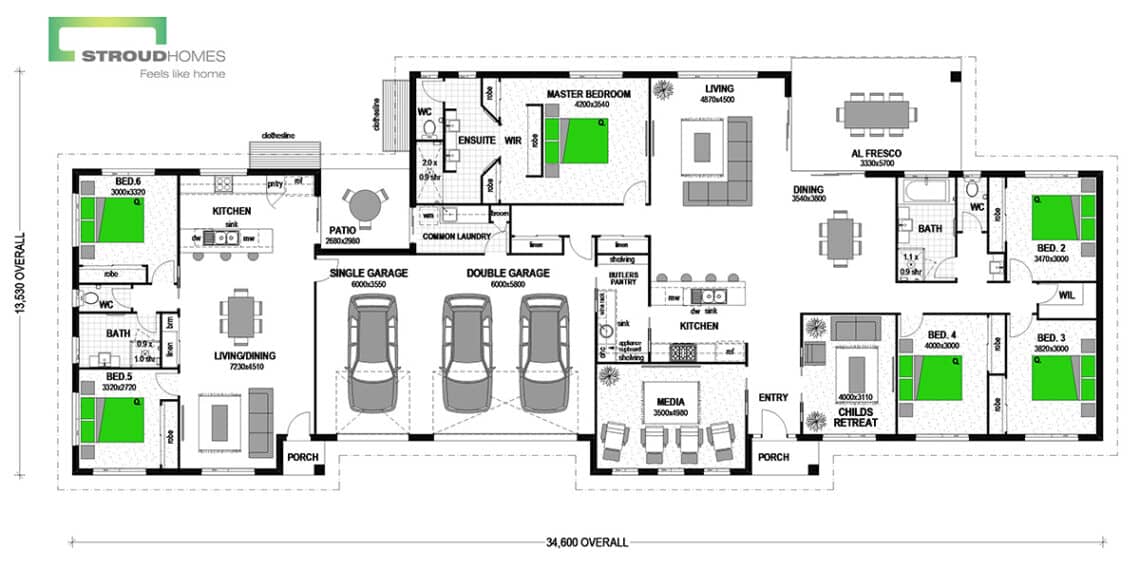

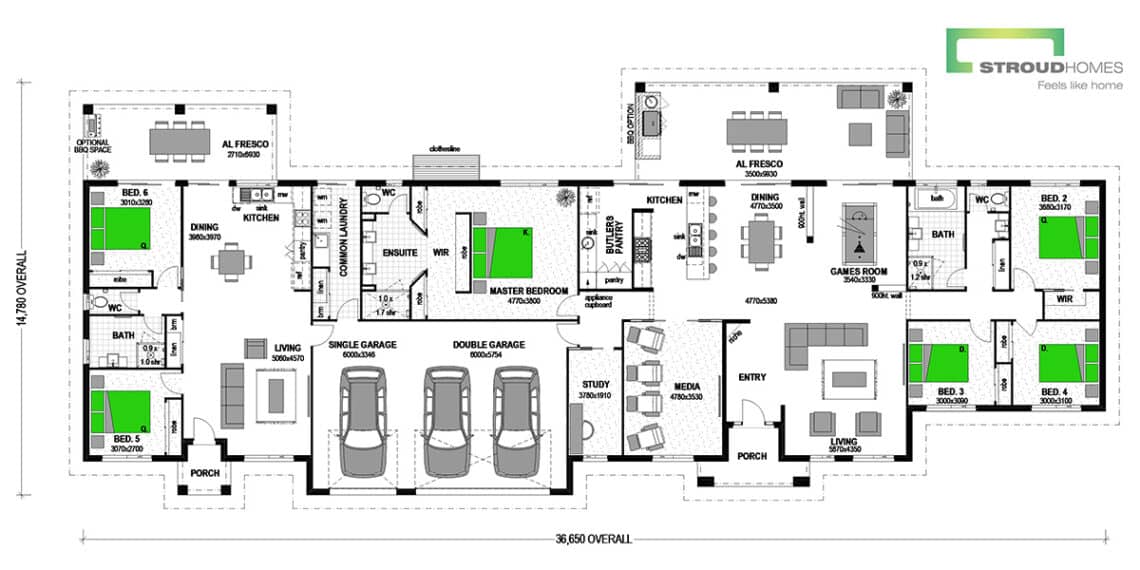

Two-Bedroom Attached Minor Dwelling Floor Plans:

Home + Income: A Win for Investors

Beyond family use, building a minor dwelling opens incredible income potential. Whether you’re planning to rent it out to long-term tenants or offer it as short-term accommodation, the rental income could help you pay down your mortgage faster.

Rents vary from one suburb to another however as a rule rent on a new two-bedroom minor dwelling (granny flat) in the lower percentile would be from $450 per week. Lenders are increasingly looking at home-and-income builds with favour because the additional rental income reduces the risk of default. That means you might even qualify for a larger loan or better terms.

As borrowing rates start to ease, so construction loans become more attractive. Banks often view homes with attached minor dwellings as lower risk since the property essentially becomes two income streams in one. This growing trend in New Zealand aligns perfectly with a rising demand for rental properties, making it a solid strategy for building wealth.